REEP supports increases in the excise tax as a health promotion tool in South Africa

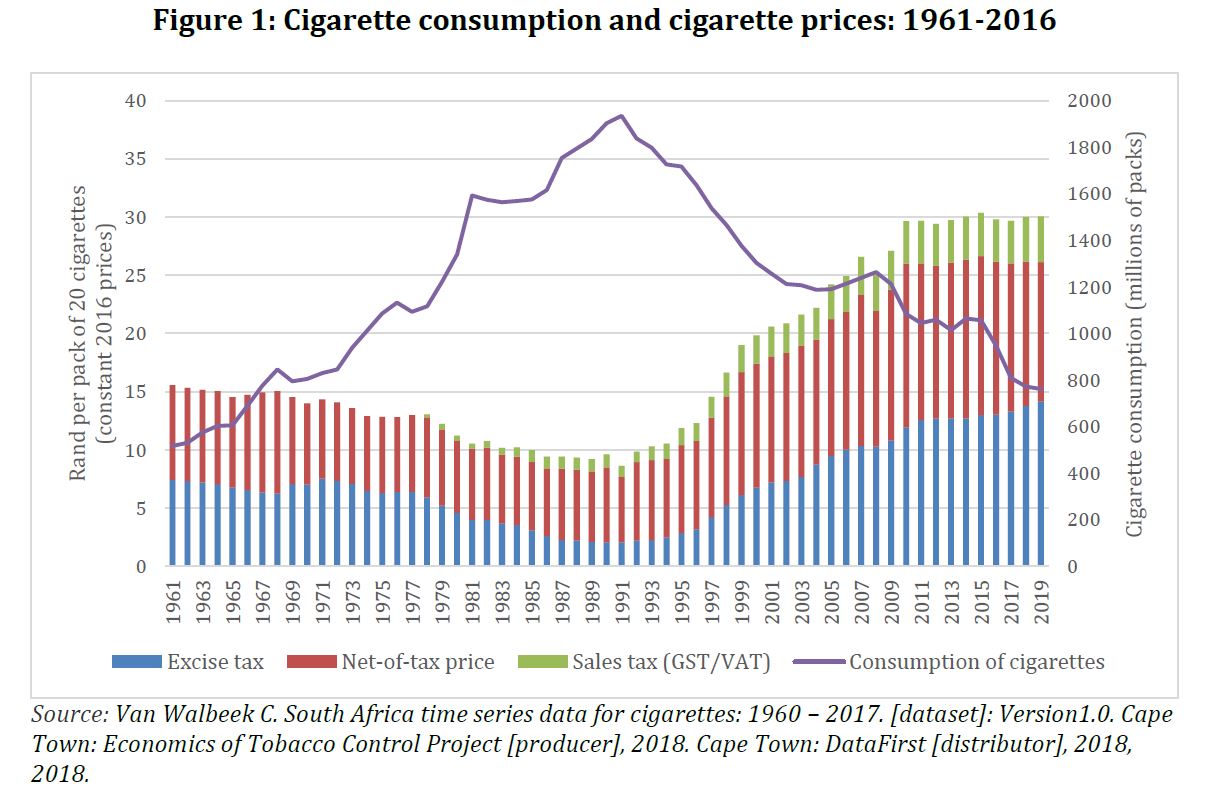

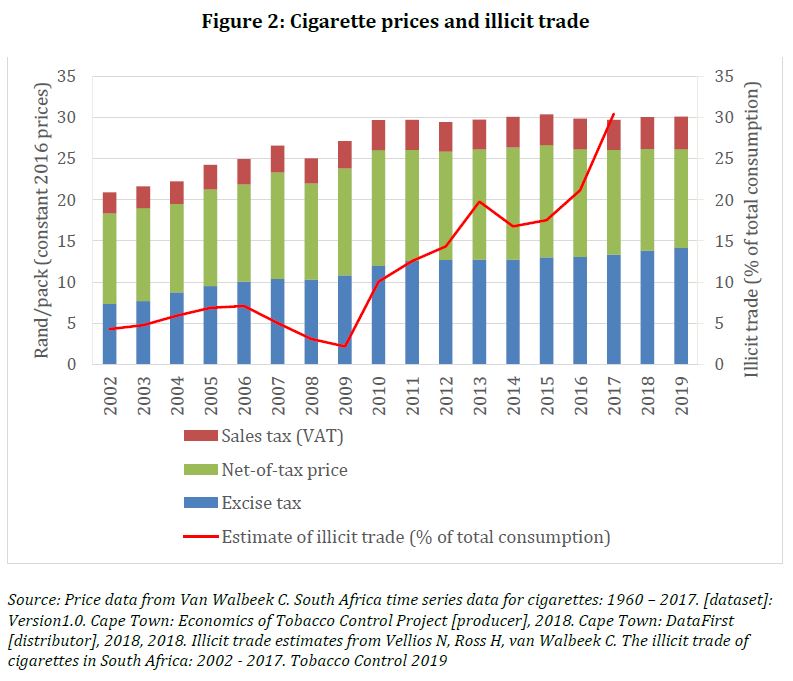

On 14 November 2019 REEP made a submission to the Standing Committee on Finance regarding tobacco excise taxes and illicit trade in South Africa. See the letter here. The background to this submission was that the tobacco industry has been lobbying government to freeze the nominal excise tax on tobacco products, in light of the very high prevalence of illicit cigarettes. We argued that the illicit trade problem is the result of poor enforcement, rather than by increases in the excise tax.

The Committee recently published its report, in which they state the following:

“The Committee received a number of submissions from the tobacco industry calling for a freeze in excise duty increase for the next three years. It was variously submitted that an increase in excise duty leads to an increase in price for consumers of legal tobacco products, driving these consumers to cheaper illegal products and leading to an increase in the availability of illicit products. This, it was submitted, will have a deleterious effect on the legal tobacco industry and affect small and emerging farmers and jobs, as consumers shift to illicit products. This also led to revenue losses of as much as R9 billion per annum as illicit tobacco traders do not pay taxes, it was said. Many submissions were also made during the Medium Term Budget Policy Statement hearings from various tobacco industry organisations/associations.

The Committee agrees with National Treasury and SARS [South African Revenue Service] that the increase in illicit products is as a result of weak law enforcement and tax administration challenges at SARS. The Committee invited SARS and National Treasury on 19 November 2019 to brief it on illicit tobacco trade and enforcement measures given the easy availability of illicit tobacco in the market. The Committee will focus more on monitoring law enforcement measures on illicit tobacco trade and on SARS capacity in this regard.

The Committee calls upon government to expedite its work on taxing other tobacco products such as electronic cigarettes and tobacco heating products. The main issue with tobacco excise is not only revenue, but also health promotion.”

Policy change can seldom be attributed to a single intervention, and in that respect, we will always be modest in making claims as to the impact of our work. However, it is nice to see that government policy is in line with our proposals. Given that both National Treasury and SARS respect the work of REEP, it seems likely that our intervention would have influenced their submission to the Committee. This announcement by the Standing Committee on Finance is a significant win for public health, and we are proud to have contributed.