2025

Mxolisi Zondi and Corné van Walbeek, September 2025. Modelling the impact of beer excise taxes on consumption and revenue in South Africa.

Walters, L, Econn, C, Vellios, N, and Van Walbeek, C. August 2025. Pre-print supplementary material. Public engagement on tobacco legislation: An analysis of the public hearings on South Africa’s Tobacco Products and Electronic Delivery Systems Control Bill.

2024

21 August 2024: A review of alcohol excise taxation in South Africa, by Nicole Vellios, Mxolisi Zondi, and Corné van Walbeek.

2023

Papers on "A minimum unit price on alcohol and trading times restrictions in the Western Cape":

- Trading Hours Phase 1 – Final DGMT Report

- Trading Hours Phase 2 – Final DGMT Report

- Minimum Unit Pricing – Phase 1.1 Modelling Impact of MUP

- Minimum Unit Pricing – Phase 1.2 Case Study Report

- Minimum Unit Pricing – Phase 2.1 Research and Drafting of Minimum Unit Price Implementation Guidelines for Western Cape Government

- Minimum Unit Pricing – Phase 2.2 Health and Economic Impacts

The impact of reducing trading times of retailers selling alcohol for onsite consumption: Western Cape analysis. A report prepared for DGMT by: Samantha Filby, Robert Hill and Professor Corné van Walbeek. March 2023.

Retselisitsoe Pokothoane (with oversight by Sam Filby and Corné van Walbeek). (2023). Chapter on tobacco taxation in the summary report: Global progress in implementation of the WHO FCTC Report by the Convention Secretariat, FCTC/COP/10/4 3 July 2023.

Kirsten Van der Zee. The Pacific Cigarette Company in the South African and Zimbabwean Cigarette Markets. 2023.

2022

Vaida Liutkutė-Gumarov, Lukas Galkus, Laura Miščikienė, Janina Petkevičienė, Mindaugas Štelemėkas, Tadas Telksnys, Justina Vaitkevičiūtė, Hana Ross. (2022). Estimating the Size of Illicit Tobacco Market in Lithuania: Results from the Discarded Pack Collection Method, Nicotine & Tobacco Research, Volume 25, Issue 8, August 2023, Pages 1431–1439, https://doi.org/10.1093/ntr/ntad013

Micheal Kofi Boachie, Rebecca Nana Yaa Ayifah, Mustapha Immurana, John Agyemang, Arti Singh, Hana Ross. Effect of cigarette prices on cigarette consumption in Ghana. Drug and Alcohol Dependence Reports. Oct 4;5:doi: 10.1016/j.dadr.2022.100102. eCollection 2022.

van Walbeek, C. and Mthembu, S. (2022) 'The Likely Fiscal and Public Health Effects of an Excise Tax on Sugar sweetened Beverages in Kenya,' ICTD Working Paper 141, Brighton: Institute of Development Studies, DOI: 10.19088/ICTD.2022.007.

2021

Ross, H. Lost Funds: A Study on the Tobacco Tax Revenue Gap in selected ASEAN countries. Southeast Asia Tobacco Control Alliance. Bangkok. Thailand. 2021.

S. Hoorens, Hana Ross, S. Hulme, F. Nederveen, Taylor, J., E. Disley. Study to identify an approach to measure the illicit market for tobacco products. Luxembourg: Publications Office of the European Union. 2021. DOI 10.2784/272064; ISBN 978-92-76-22767-0.

Van Walbeek, C., Adeniran, A. and Augustine, I. (2021). More on the Positive Fiscal and Health Effects of Increasing Tobacco Taxes in Nigeria. African Tax Administration Paper 25, June 2021. International Centre for Tax and Development (ICTD), Institute of Development Studies (IDS) .

Van Walbeek, C., Hill, R., Filby, S. and van der Zee, K. (2021). Market impact of the COVID-19 national cigarette sales ban in South Africa. Report 11, Wave 3: National Income Dynamics Study (NIDS) – Coronavirus Rapid Mobile Survey (CRAM).

Estelle Dauchy and Hana Ross with Campaign for Tobacco-Free Kids (CTFK) (2021). Assessing Illicit Cigarettes in Ethiopia, Results of the 2018 Empty Pack Survey. May 2021.

2020

Hana Ross. Raise Tobacco Taxes and Prices for a Healthy and Prosperous Indonesia. Jakarta, Indonesia: World Health Organization, Regional Office for South-East Asia; 2020.

ATIM (Inclu. Hana Ross, Nicole Vellios, Samantha Filby, Corné Van Walbeek) 2020. Tobacco Industry Interference Index Report for South Africa (2019).

The effects of price and non-price policies on cigarette consumption in South Africa Ernest Ngeh Tingum, Alfred Kechia Mukong and Noreen Mdege ERSA working paper 799 October 2019.

Sophapan Ratanachena-McWhortor and Hana Ross. Tobacco Industry Factoid on Illicit Trade Leading Governments Astray. Inter Press Service. Jul 21 2020.

Van Walbeek, C., Filby, S. and van der Zee, K. 2020. Back to normal? Smoking and quitting behaviour in South Africa after the tobacco sales ban results from a third survey. Report, July 2020.

Ross, H. 2020. Still Defective: Asia Illicit Tobacco Indicator 2017 Report. Bangkok: Southeast Asia Tobacco Control Alliance.

Van Walbeek, C., Filby, S. and van der Zee, K. 2020. Smoking and Quitting Behaviour in Lockdown South Africa: Results from a second survey. Report, July 2020.

Van Walbeek, C., Filby, S. and van der Zee, K. 2020.Lighting Up the Illicit Market: Smoker’s Responses to the Cigarette Sales Ban In South Africa. Report, May 2020.

van Walbeek, C. (2020). Case Studies in Illicit Tobacco Trade: South Africa [Case Study]. Tobacconomics.

2019

Hana Ross and Evan Blecher. 2019. Illicit Trade in Tobacco Products Need Not Hinder Tobacco Tax Policy Reforms and Increases. Tobacconomics White Paper. Chicago, IL: Tobacconomics, Health Policy Center, Institute for Health Research and Policy, University of Illinois at Chicago.

Kirsten van der Zee and Corné van Walbeek (2019). Botswana, Lesotho, and South Africa. in: Confronting Illicit Tobacco Trade : a Global Review of Country Experiences Chapter 19 pg 551-578, Working Paper 133959 (Global Tobacco Control Program Washington, D.C. : World Bank Group.

2018

Berthet Valdois, J., Van Walbeek, C.P. and Tingum, E.N., 2018. A review of cigarette taxes in Mauritius. Report written for the Ministries of Health and Finance in Mauritius.

Hana Ross. Tobacco Industry Strategies to Reduce Tax Liability. Cape Town: SALDRU, UCT. SALDRU Working Paper Number 225. 2018.

Van Walbeek, CP and Chelwa, G, 2018. Using price-based interventions to reduce abusive drinking in the Western Cape. Report written for the Western Cape Government with funding from the DG Murray Trust.

2016

U.S. National Cancer Institute and World Health Organization. The Economics of Tobacco and Tobacco Control. National Cancer Institute Tobacco Control Monograph 21. NIH Publication No. 16-CA-8029A. Bethesda, MD: U.S. Department of Health and Human Services, National Institutes of Health, National Cancer Institute; and Geneva, CH: World Health Organization; 2016. Van Walbeek, C. & Ross, H. were co-authors of this monograph.

2015

Chaloupka, F., Edwards, S., Ross, H., Diaz, M., Kurti, M., Xu, X., Pesko, M., Merriman, D. & DeLong, H. (2015) Preventing and Reducing Illicit Tobacco Trade in the United States. Centers for Disease Control and Prevention.

Ross, H. 2015. Review of the ITIC’s ASEAN Excise Tax Reform: A Resource Manual. Bangkok, Southeast Asia Tobacco Control Alliance (SEATCA). DOI: 10.13140/RG.2.1.1423.6885

Ross, H. & Tesche, J. 2015. Undermining Government Tax Policies – Common strategies employed by the tobacco Industry in response to tobacco tax increases.

Ross, H. & Vellios, N. 2015. Additional examples_Undermining Government Tax Policies_version 2.

Ross, H. & Tesche, J. 2015. Des politiques fiscales nationales déstabilisées – Les stratégies courantes de l’industrie du tabac face aux majorations des taxes sur le tabac.

Ross, H. & Tesche, J. 2015. Socavar laspolíticas impositivasdel gobiernoEstrategias comunes empleadas por la industria tabacalera en respuesta alos incrementos de los impuestos al tabaco.

Ross, H., Husain, M.J., Kostova, D. et al. 29 May 2015. Centers for Disease Control and Prevention. Morbidity and Mortality Weekly Report. Approaches for Controlling Illicit Tobacco Trade_Nine Countries and the European Union.

Ross, H. 2015. A critique of the ITIC_OE Asia 14 Illicit Trade Indicator 2013.

Ross, H. 2015. Measures to Control Illicit Tobacco Trade.

Ross, H. 2015. Controlling Illicit Tobacco Trade_International experience.

Ross, H. 2015. Understanding and measuring tax avoidance and evasion – A methodological guide.

Kruger, L., van Walbeek, C., & Vellios, N. 2015. Prevalence of waterpipe smoking among Western Cape students.

Ross, H. Failed: A Critique of the ITIC/OE Asia-14 Illicit Tobacco Indicator 2013. SEATCA. May 20, 2015. DOI: 10.13140/RG.2.1.4987.1521.

Ross, H. 2015. Measures to Control Illicit Tobacco Trade & Controlling illicit tobacco trade: International experience. Prepared for the Economics of Tobacco Control Project¸ School of Economics, University of Cape Town and Tobacconomics, Health Policy Center, Institute for Health Research and Policy, University of Illinois at Chicago. May 2015.

Van Walbeek, C. February, 2015. A Review of Excise Taxes on Cigarettes in Jamaica.

Rooney, C. and Van Walbeek, C.P. 2015. Some determinants of academic exclusion and graduation in three faculties at UCT. Saldru Working Paper no. 161.

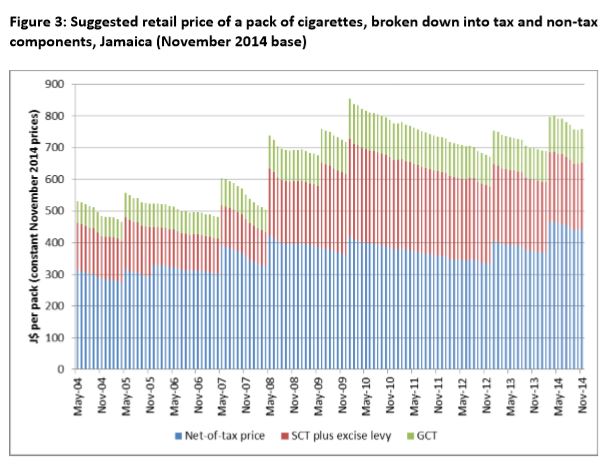

Van Walbeek, C.P., Barnett, J., Booth, A. and Lewis F.B. 2015. A review of cigarette excise taxes in Jamaica. Report written for the Jamaican Ministry of Health.

Hana Ross. Still Defective: Asia Illicit Tobacco Indicator 2017 Report. Bangkok: Southeast Asia

Tobacco Control Alliance. 2020.