REEP Project Researchers: Prof Corné van Walbeek, Dr Hana Ross, Dr Jean Tesche, Dr Micheal Kofi Boachie and Ms Kirsten van der Zee

Project Partners: Consortium pour la Recherche Economique et Sociale (CRES) and the International Centre for Tax and Development (ICTD)

Tobacco tax reform in West Africa: Purpose

Africa is vulnerable to the tobacco industry. It has a large and young population, rapid economic growth, a desire to attract foreign investment, and weak tobacco control policies. Although smoking prevalence in many African countries is modest, preventing its rise, especially amongst youth, remains a huge challenge.

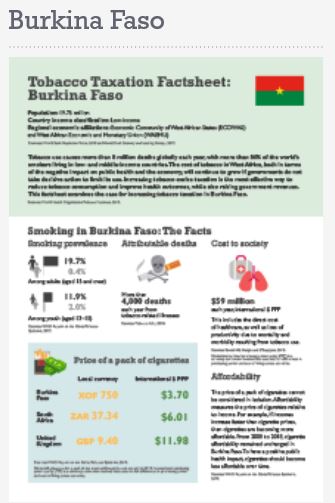

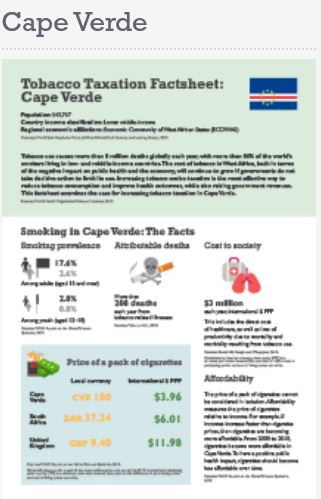

Policymakers are often unaware of the win-win benefits of increased tobacco taxation; that is, increasing government revenues while reducing consumption and improving health outcomes for the population. Furthermore, the tobacco industry is very actively lobbying against tobacco taxes, making spurious cases for the wrong type of tax structure, and propagating false arguments about the likely effects of increased taxation, such as exaggerating the likelihood of increases in tobacco smuggling. Countries often struggle to counter the industry’s claims that tax increases are going to hurt the poor, lead to job losses, and promote illicit trade.

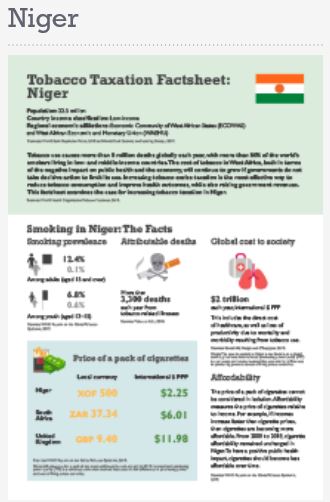

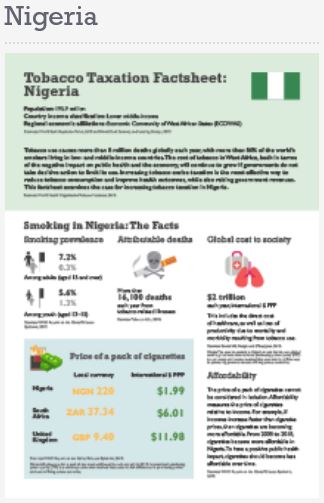

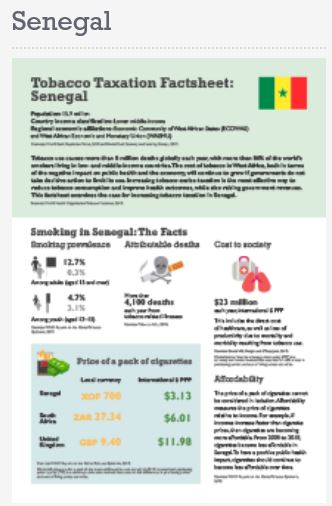

In a positive step, the Economic Community of West African States (ECOWAS) adopted a new directive on tobacco taxation in December 2017. The goal of the research project is to assist member states in implementing the directive, by providing both regional analysis and in-depth diagnostic and economic modelling studies in three key countries: Nigeria, Senegal, and Ghana.

Economics of Tobacco Control Research Initiative meeting, February 2019, London, UK.

The Research

This project will be conducted in partnership with the Consortium pour la recherche économique et sociale (CRES) based in Senegal and the International Centre for Tax and Development (ICTD). The research will identify:

-

Best practices in tobacco taxation, focusing on the impact of tobacco tax increases on tobacco consumption, government tax revenue and industry pricing of tobacco products

-

The economic impact of tobacco control policies

-

Policy barriers to fiscal measures

-

Financing mechanisms for tobacco control

This project will entail the close involvement of West African researchers and policymakers in designing and conducting the research, and translating it into specific recommendations to be communicated more broadly to promote effective policy implementation.

Inception meeting, May 2019, Dakar, Senegal.

Project Outputs

Workshops

On 22 & 23 February 2022, CRES, REEP and ICTD hosted the National Workshop on Tobacco Taxation, under the banner of the Tobacco Taxation Reforms in West Africa project. The workshop was held in Saly Senegal and attended by Representatives from the West African Economic and Monetary Union (WAEMU), the Economic Community of West African States (ECOWAS) and various Senegalese government ministries.

Dr Hana Ross and Kirsten van der Zee of REEP attended and presented at the workshop. Dr Ross presented key academic findings from the project, specifically those that make the case for increasing excise taxes in the region, and the harmonisation of the two directives. Kirsten presented a new simulation model which determines the feasible cost for governments to implement a track and trace solution for tobacco.

A key mandate of the workshop was to motivate for the harmonisation of the WAEMU and ECOWAS Directives on tobacco taxation. The workshop provided a key platform for engagement between WAEMU, ECOWAS and national government representatives.

Watch a video of the workshop here.

Journal Articles

-

Micheal Kofi Boachie, Mustapha Immurana, John Kwaku Agyemang and Hana Ross (2022). Cigarette Prices and Smoking Experimentation in Sierra Leone: An Exploratory Study. Tobacco Use Insights, Volume 15: 1–8. DOI: 10.1177/1179173X221078189.

-

Micheal Kofi Boachie, Mutsapha Immurana, Ernest Tingum Ngeh, Noreen Dadirai Mdege and Hana Ross (2022). Effect of relative income price on smoking initiation among adolescents in Ghana: evidence from pseudo-longitudinal data. BMJ Open. ISSN 2044-6055 (In Press).

Policy briefs

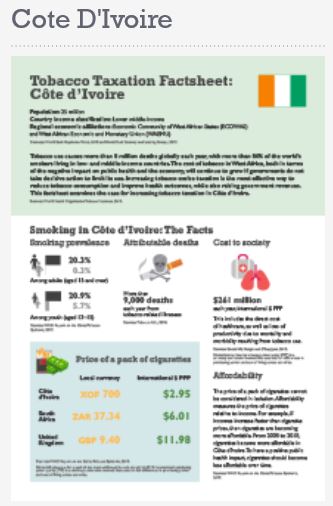

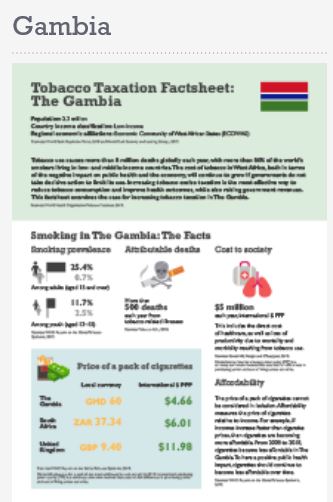

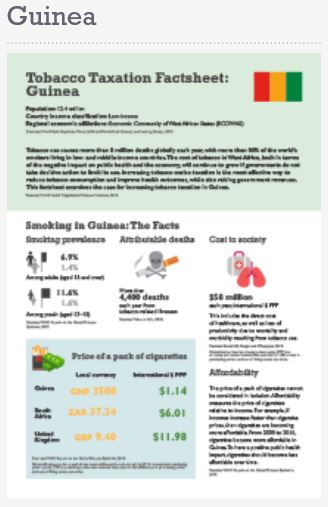

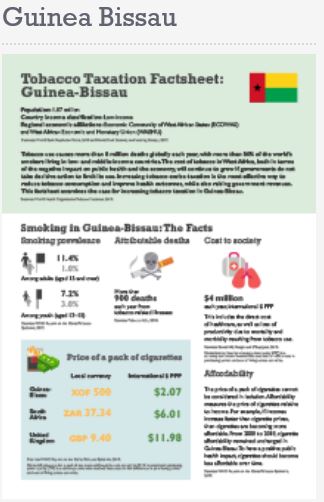

Factsheets

https://www.ictd.ac/theme/tobacco-taxation/

This project is part of the IDRC and CRUK Economics of Tobacco Control Research Initiative, and will collaborate closely with another project funded under the same initiative being conducted by the Centre for the Study of the Economies of Africa in Nigeria.