REEP Project Researchers: Dr Hana Ross, Ms Nicole Vellios, Ms Kirsten van der Zee, Ms Megan Little and Mr Zunda Chisha.

Project Partners: The Cancer Research UK (CRUK), Global Alliance for Chronic Diseases (GACD), and DataFirst.

Purpose: Study the impact of tax and price policy on illicit cigarette trade in selected low and middle income countries.

REEP (formerly the ETCP) was chosen by the Cancer Research UK (CRUK) to lead a 39 month project starting in November 2016, to investigate the relationship between tobacco tax increases and the illicit trade in cigarettes in four low- and middle-income countries (LMICs).

The aims of this study were two-fold. The first was to contribute to existing knowledge regarding excise tobacco taxes and illicit tobacco trade in LMICs, and the second was to develop in-country capacity in LMICs around measuring the size of illicit tobacco market, by establishing a close working relationship between REEP and the in-country teams.

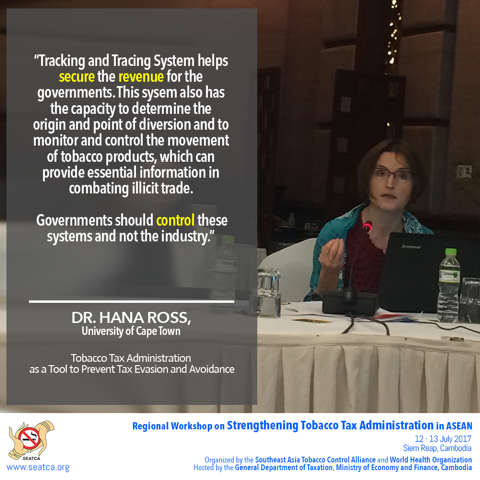

The tobacco industry lobbies extensively against tax increases, arguing that these drive up illicit trade in tobacco. This makes providing empirical evidence on actual market responses to higher taxes imperative. If tax increases do not substantially change the magnitude and the nature of illicit tobacco trade, the industry arguments have little ground - and governments will meet their revenue targets. Empirical evidence shows that higher taxes improve public health, even in the presence of illicit trade market, by lowering demand through higher prices leading to lower smoking prevalence.

We identified four countries in which a tax increase was anticipated between 2017 and 2018, and worked closely with in-country teams to capture data on the size of illicit cigarette market pre and post a tax increase. The methodology varied by country to accommodate local conditions, but included examining cigarette packs (discarded or from retail outlets/smokers), surveying tobacco users for self-reported pack features, comparing tax-paid sales with consumption estimated from surveys (gap analysis), and econometric modelling of cigarette demand through regression analysis. The analysis of the pre- and post-tax increase data revealed the extent to which tax increases in the four countries affected illicit trade.

Evidence from this project has been published in the special issue of Tobacco Control journal:

- Little M, Ross H, Bakhturidze G, et al. Illicit tobacco trade in Georgia: prevalence and perceptions. [18 January 2019]

- Ross, H., van Walbeek, C. and Vellios, N. Illicit cigarette trade in South Africa: 2002–2017 [August, 2019]

- Chisha Z, Janneh ML, Ross H. Consumption of legal and illegal cigarettes in the Gambia. [30 May 2019]

- Ross H, Vellios N, Batmunkh T, et al. Impact of tax increases on illicit cigarette trade in Mongolia. [19 June 2019]

- van der Zee K, Vellios N, van Walbeek C, et al. The illicit cigarette market in six South African townships. [11 March 2020]

In addition to publishing the results in Tobacco Control, the results were disseminated through media briefings, webinars, workshops, policy briefs and conference presentations (for example, read more here). This facilitated REEP's engagement with policy makers and researchers in LMICs.

REEP is also leveraging its status as the FCTC Secretariat Knowledge Hub for further dissemination. The datasets from the project are available via the DATA project and via a publication: Rossouw L, Vellios N. Dataset on Discarded Cigarette Packs in Mongolia. Data in Brief. October 2019. Vol. 26. doi.org/10.1016/j.dib.2019.104452.