Cigarette prices soar during lockdown, according to latest REEP study

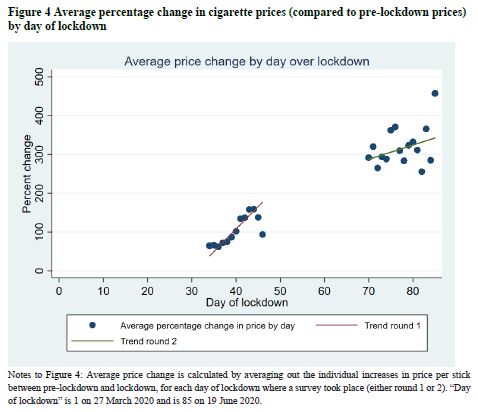

Recent research has shown that the average price of cigarettes has increased by nearly 250% compared to pre-lockdown levels. Based on a second online survey, conducted between 4 and 19 June 2020, REEP researchers found that the average price per cigarette was R5.69, or R114 per pack of 20. Some respondents reported prices as high as R300 per pack of 20 or R3000 per carton of 200 cigarettes. This is significantly higher than the 90% increase in cigarette prices observed in an earlier survey in May 2020 by the same research team.

The study, which was based on more than 23 000 respondents, was conducted by a research team consisting of Professor Corné van Walbeek, Sam Filby and Kirsten van der Zee.

Nearly 30% of respondents indicated that they had tried to quit during the lockdown. The main reason for wanting to quit, as indicated by 56% of respondents who tried to quit, was the high prices of cigarettes. Another 14% of respondents indicated that they had tried to quit because they were unable to find cigarettes. Only 11% of respondents that tried to quit indicated that they did so because of the sales ban.

There are large demographic disparities amongst those who reported that they had successfully quit smoking cigarettes. Nearly half of African females and more than a third of African males who answered the survey indicated that they had successfully quit smoking. At the other extreme, fewer than 4% of White male and fewer than 2% of White female respondents indicated that they had successfully quit smoking during the lockdown. More than 70% of smokers who quit did so before 2 May 2020, i.e. during level 5 lockdown. According to Prof. van Walbeek, “The intended lockdown benefit of people quitting smoking was mostly realised in lockdown level 5. The percentage of respondents who quit subsequently has decreased to little more than a trickle”.

The average pre-lockdown consumption of quitters was about half of that of continuing smokers, suggesting that quitters were less addicted than continuing smokers.

Of the respondents who continued smoking, 93% indicated that they had been able to purchase cigarettes during the lockdown period. Most respondents had purchased cigarettes through informal channels, such as friends and family (27%), spaza shops (25%), street vendors (11%) and WhatsApp groups (8%). Formal retail outlets, which were the predominant source of cigarettes before lockdown (53%), have all but disappeared (0.3%).

More than 50% of all cigarettes purchased by respondents in their most recent purchase were brands from three companies affiliated with the Fair-Trade Independent Tobacco Association (FITA). These companies are Gold Leaf Tobacco Corporation (26%), Carnilinx (14%) and Best Tobacco Company (11%). British American Tobacco, which has dominated the industry for decades, had fallen to fifth place, with its brands having been purchased by only 9% of survey respondents who continue to smoke.

Van Walbeek continued: “The fact that FITA, which primarily represents the local manufacturers, went to court to get the sales ban overturned is peculiar and ironic because our results show that FITA members have benefitted disproportionately from of the sales ban. They have greatly increased their market share within the sample and have likely been making extraordinary profits, given their highly inflated prices.”

The average daily number of cigarettes smoked by continuing smokers decreased from 16.4 cigarettes pre-lockdown to 13.1 cigarettes in June 2020. Half of these respondents smoked less during lockdown than before lockdown, 15% smoked more, and 35% smoked the same amount.

82% of respondents indicated that, before lockdown, they never shared an individual cigarette with someone else. However, during lockdown the percentage of smokers who never shared a cigarette decreased to 74%. The number of people who indicated that they regularly shared individual cigarette sticks (more than 50% of cigarettes smoked were shared) increased from 1.7% to 8.9%, an increase of 430%.

The tobacco market has been destabilised. Manufacturers that were previously operating in the shadow of the multinationals have greatly increased their market share amongst the survey respondents. It seems likely that there will be a price war after the sales ban is lifted. The multinationals, with the support of their foreign-based principals, would want to regain some of their market share. Their local rivals, probably buoyed up by the profits earned over the lockdown period, would want to hold on to their new market share. In the absence of advertising and other conspicuous forms of marketing, prices are likely to drop below their pre-lockdown levels.

Could the government have taken a different approach? According to Van Walbeek, “An alternative approach, which would have allowed the government to continue raising revenue, would have been to substantially increase the excise tax. Currently the excise tax is R17.40 for 20 cigarettes. If the government had doubled, or even tripled, the excise tax, it would substantially increase the price of tax-paid cigarettes, which would encourage smokers to quit or reduce consumption. The result would be similar to that of a sales ban, but the revenue would continue to flow to government and less would end up in the hands of the tobacco industry. More than a quarter of people who quit during lockdown indicated that they would start smoking again after the sales ban is lifted. A permanent increase in the excise tax would encourage quitters to remain non-smokers. Of course, critics of higher excise taxes would say that it encourages illicit trade. The evidence, in South Africa and elsewhere, has shown that illicit trade is less a tax problem, and more an enforcement problem. Many countries have been able to decrease the size of the illicit market, while simultaneously increasing excise taxes. Even if illicit trade were to increase as a result of lax enforcement following an excise tax increase, illicit trade would certainly not make up 100% of the market, as it currently does.”

Van Walbeek concluded, “The one lesson that we learn from the sales ban and the associated chaos in the market is that smokers are willing to pay a much higher price than the R25 to R45 per pack that they were paying before the lockdown. National Treasury should substantially increase the excise tax on tobacco products when the sales ban is lifted. Such a strategy will have good public health consequences and will allow the government to claw back the loss of revenue that it suffered during the lockdown. The crucial proviso is that it can control the illicit market. That, in the current scenario, will be hard to do, but there are solutions available, such as digital tax stamps and Track and Trace solutions.”

Read the report in full here.