Report: A review of alcohol excise taxation in South Africa

In August 2024, REEP completed a comprehensive research report titled ‘A review of alcohol excise taxation in South Africa’. The research was funded by RESET Alcohol (led by Vital Strategies and funded by Open Philanthropy). The project duration was 15 months (1 June 2023 to 21 August 2024). Nicole Vellios, Mxolisi Zondi, and Corné van Walbeek worked on this research project.

The aim of the research was to identify gaps in South Africa’s alcohol excise tax framework, and to provide recommendations on how to tighten alcohol excise taxation in South Africa. Pricing policies are a highly effective measure to reduce alcohol-related harm. Improving the excise tax framework for alcohol is important because the harmful use of alcohol is a critical public health concern in South Africa. The economic and social costs caused by alcohol consumption are vast. South Africa has the highest reported rates of Fetal Alcohol Syndrome globally. Estimates from several publications indicate that the number of alcohol-attributable deaths in South Africa is in the range of 36,200 to 62,300 deaths per year.

The main focus of the report is excise taxes. In South Africa, excise taxes on beer and ciders (R135.89/L of AA) and spirits (R274.39/L of AA) are applied per litre of absolute alcohol (international best practice). Excise taxes on wine (R5.57/L), Traditional African beer (R0.0782/L), and Traditional African beer powder (R0.0347/kg) are applied by volume. These rates are for 2024/25.

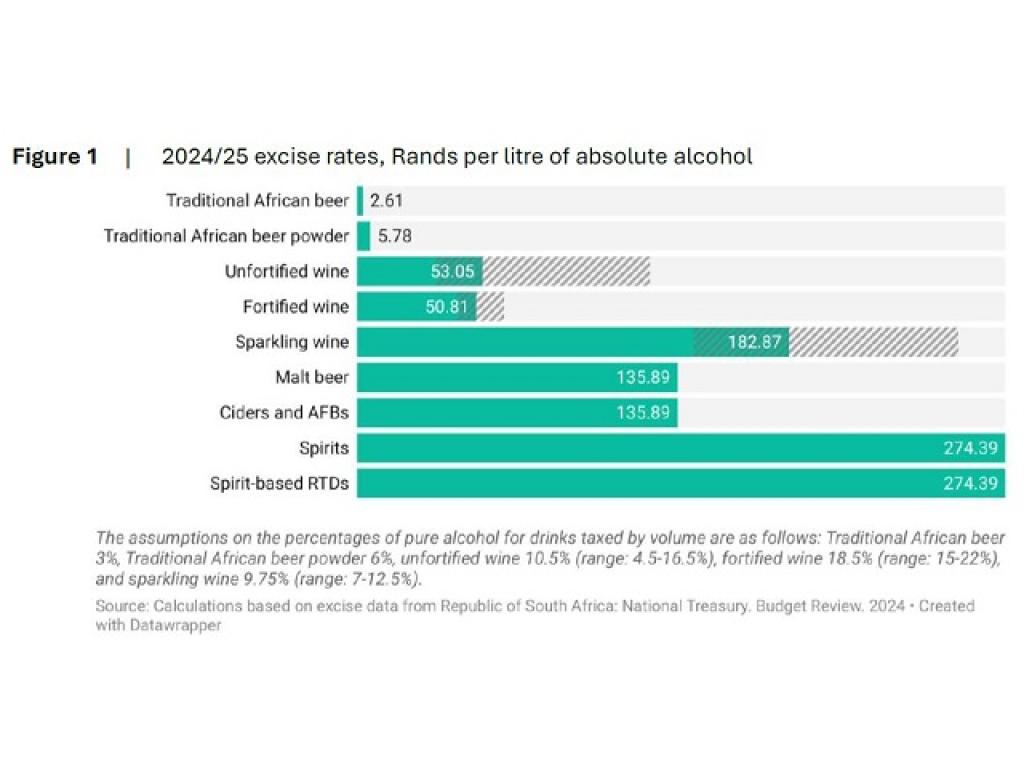

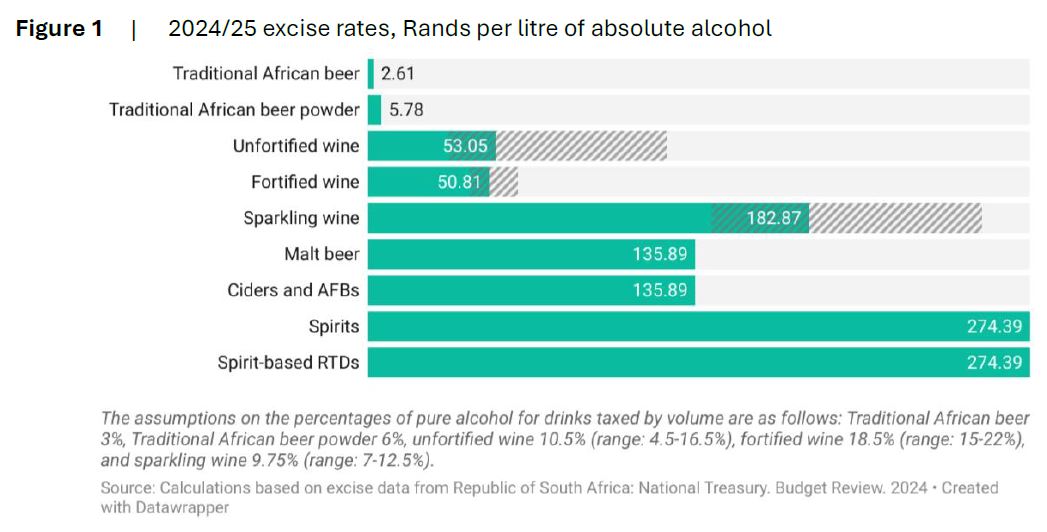

The main weakness in South Africa’s excise tax policy is that wine is taxed too low. The special treatment that wine receives has a long history. Likewise, the excise taxes on beer, Traditional African beer and Traditional African beer powder, and instant beer are also very low. There are currently very large differences in the estimated excise duty rates, based on absolute alcohol, for the various alcoholic beverages (Fig 1). The relative differential rates have been widening in South Africa in recent years.

Per litre of pure alcohol, spirits attracts by far the highest excise tax, double that of malt beer. The excise tax based on absolute alcohol for unfortified wine is a fifth of the excise tax for spirits. The excise tax based on the absolute alcohol content for Traditional African beer powder is only 4% of the excise tax for beer. The excise tax on Traditional African beer and Traditional African beer powder has not increased in two decades, with the result that the excise taxes are now negligible.

Recommendations:

- As far as possible, there should be a convergence in the excise tax rates between the various alcohol categories. There is divergence (Fig 1), and this is bad for public health as consumers can trade down to cheaper alcoholic beverages.

- The government should consider implementing a Minimum Unit Price at the national level. The Western Cape is currently looking at this from a provincial perspective. It could serve as a test case for national implementation. Also, some negative aspects related to a provincial MUP (such as interprovincial smuggling) would be resolved if it is implemented nationally.

- The taxation on wine should be reviewed. The cost per litre of absolute alcohol is much lower for wine than for beer and spirits.

- Increase the excise tax on beer, given that beer is the drink of choice among South Africans who drink excessively.

- Investigate tax administration on sugar-fermented beverages (SFBs). Even though SFBs are subject to the same high spirits excise tax, the prices at which SFBs are sold suggest that excise taxes are not paid.

- Tax instant beer powder at a higher rate. Currently, instant beer powder is taxed at the Traditional African beer powder rate. For historical and political reasons Traditional African beer and Traditional African beer powder are taxed at extremely low rates. The best option would be to increase the excise tax on Traditional African beer and Traditional African beer powder. If this is not feasible, an appropriately high tax should be imposed on instant beer powder by creating a new, separate, category for it.

- Remove anomalies in the excise tax tables. Some categories of alcohol (like liqueurs with alcohol content below 23%) are currently taxed at R109.76/L of AA, which is substantially lower than the spirits rate of R274.39/L of AA. Two categories of ‘other fermented beverages’ are taxed at R109.76/L of AA, which is lower than the beer rate of R135.89 applied to other categories of ‘other fermented beverages’.

We view this research report as a discussion document, that can be updated following stakeholder dialogue. As such, we welcome any feedback that can improve the report.

Read the policy brief:

And the full report: