New research report on modelling newly proposed alcohol taxes by National Treasury

In September 2025, Mxolisi Zondi and Corné van Walbeek published a research report titled “Modelling the impact of beer excise taxes on consumption and revenue in South Africa.”

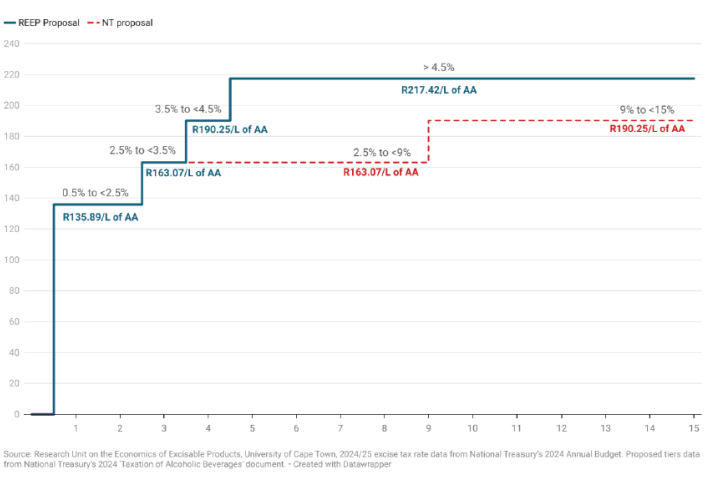

The report was developed in response to the National Treasury’s discussion document, published in November 2024. The discussion document proposes substantial changes to the excise taxes on beer and spirits. In particular, it proposes that higher-alcohol beer taxed at a higher rate per unit of absolute alcohol than low-alcohol beer. The REEP study models the effects of the newly proposed tax structures, suggests areas for improvement in their design, and evaluates their impact.

Based on the experience of the sugar-sweetened beverage tax, where producers reformulated the beverages to reduce the tax liability, the REEP report argues that well-considered tax thresholds can encourage beer producers to reduce the alcohol content of their products.

While the REEP report endorses the National Treasury's proposal of taxing higher-alcohol beer at a higher rate, it believes that the thresholds (currently at 2.5% and 9% alcohol by volume (ABV)) are not optimal, and are unlikely to encourage beer producers to reduce the alcohol content of their products. Most beer in South Africa has an alcoholic content of between 4% and 6% ABV. REEP proposes that the thresholds be set at 2.5%, 3.5% and 4.5%. This will create strong incentives for producers to reduce the alcoholic content of their beverages.

The report assesses how tiered beer excise taxes—especially those based on alcohol content (ABV)—affect alcohol consumption, government revenue, and industry dynamics. Using a tax simulation model, the research compares the National Treasury’s proposal with REEP’s alternative proposal under various scenarios.

The modelling indicates that the current proposal by National Treasury is unlikely to result in any reduction in the average alcohol content of beer. The higher excise taxes are likely to increase government revenue by about 18% and reduce beer consumption by 2%. On the other hand, if the National Treasury were to set the tax thresholds at 2.5%, 3.5% and 4.5% ABV, and if beer producers respond to them in the predicted ways, this could result in a decrease (of up to 15%) in the volume of absolute alcohol consumed, even though the volume of beer consumed is unlikely to change much. The REEP proposal is expected to increase government revenue by 13%.

This research supports ongoing policy dialogue and provides evidence to inform the reform of South Africa’s alcohol excise tax framework. The report can be found here, and the policy brief here.

This study was funded by RESET Alcohol, a global initiative led by Vital Strategies and supported by Open Philanthropy.